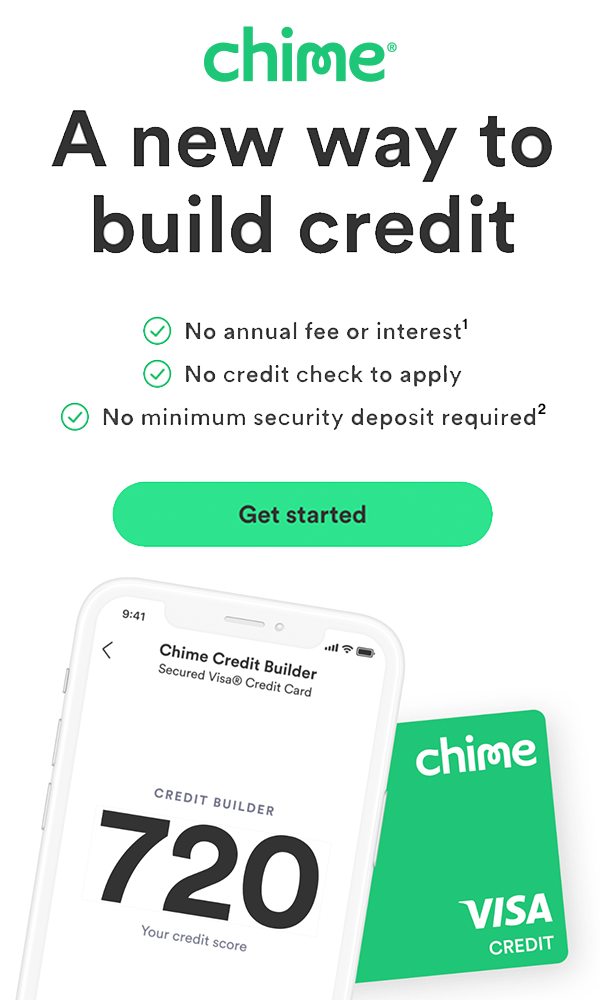

Chime - A new way to build credit

Wednesday, August 7, 2024

|

| This is an advertisement. You are receiving this message because you opted-in to receive emails from a third-party publisher. This email was delivered by a third-party, on behalf of Chime. ©2023. All rights reserved. PO Box 417 San Francisco, CA 94104. The secured Chime Credit Builder Visa® Card is issued by Stride Bank, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted. To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Chime Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits. 1Out of network ATM withdrawal fees may apply. See here for details. 2Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder Visa card, which means you can spend up to this amount on your card. This is money you can use to pay off your charges at the end of every month. To unsubscribe from this marketing partner please click here, |

Sent By: Next Web Guide

1510 Castle Hill Ave #1045, Bronx NY 10462

You are receiving this ad-supported email because

you opted in at one of the Next Web Guide websites.

Unsubscribe

posted by Myrna Sophia at 1:03 AM

![]()

![]()

0 Comments:

Post a Comment

<< Home